colorado springs vehicle sales tax rate

The Colorado sales tax rate is currently. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state.

Used Car Dealer In Colorado Springs Co 80909 Drivetime

This is the total of state county and city sales tax rates.

. This table is for all motor vehicles except those shown below including motorcycles motor homes sedans coups and sports utility vehicles. What is the sales tax for a car in Colorado Springs. What is the Colorado sales tax rate for.

A Colorado Springs resident owns a home in the C ity and a ranch in the mountains. Motor vehicle dealerships should review the DR 0100 Changes for Dealerships document in addition. Effective January 1 2016 through December 31 2020 the City of Colorado Springs sales and use tax rate is 312 for all transactions occurring during this date range.

The ownership tax rate is assessed on the original taxable value and year. Sale Use Tax Topics. 27 lower than the maximum sales tax in CO The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado.

Line 4 multiplied by 10 X 010 equals Auto Rental Tax due to the City of Colorado Springs. The December 2020 total local sales tax rate was 8250. The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state sales tax and 535 Colorado Springs local sales taxesThe local sales tax consists of a 123 county.

The County sales tax rate is. The current total local sales tax rate in Colorado Springs CO is 8200. The minimum combined 2022 sales tax rate for Pagosa Springs Colorado is.

The rate is 29. Sales Tax Breakdown Colorado Springs. What is the sales tax rate in Pagosa Springs Colorado.

The 2018 United States. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. A state tax rate of 29 applies to all car sales in Colorado but your total tax rate will include county and local taxes as wellwhich may add up to 8.

In Colorado localities are allowed to collect local sales taxes of up. Vehicles do not need to be operated in order to be assessed this tax. Did South Dakota v.

When purchasing a new. Sales Tax Rates in the City of Glenwood Springs. 85 of the Manufacturer.

The average cumulative sales tax rate in Colorado Springs Colorado is 781 with a range that spans from 513 to 863. See Department publication Colorado SalesUse Tax Rates DR 1002 for service fee percentages for state-administered local sales taxes. State of Colorado 290 Garfield County 100 RTA Rural Transit Authority 100 City of Glenwood Springs.

The average total car. For instance if you purchase a vehicle from a private party for 20000 then you will. Colorado collects a 29 state sales tax rate on the purchase of all vehicles.

29 Colorado collects a 29 state sales tax rate on the purchase of all vehicles. You will have to pay sales tax on any private car sales in Colorado. Wayfair Inc affect Colorado.

Sales Use Tax Topics. The Sales Tax Return DR 0100 changed for the 2020 tax year and subsequent periods. Ownership tax is in lieu of personal property tax.

The vehicle is principally operated and maintained in Colorado Springs. Motor Vehicles 4 Revised November 2021 Motor vehicle leases In general motor vehicle leases are considered retail sales and are subject to Colorado sales tax. The Colorado Springs sales tax rate is.

The 1 rate applies to short-term less than 30 consecutive days rentals of automotive vehicles. This includes the rates on the state county city and special.

Layers Of Taxation Factor Into Colorado Vehicle Purchases Business Gazette Com

Fuel Taxes In The United States Wikipedia

Ford Car Service Center In Colorado Springs Phil Long Ford

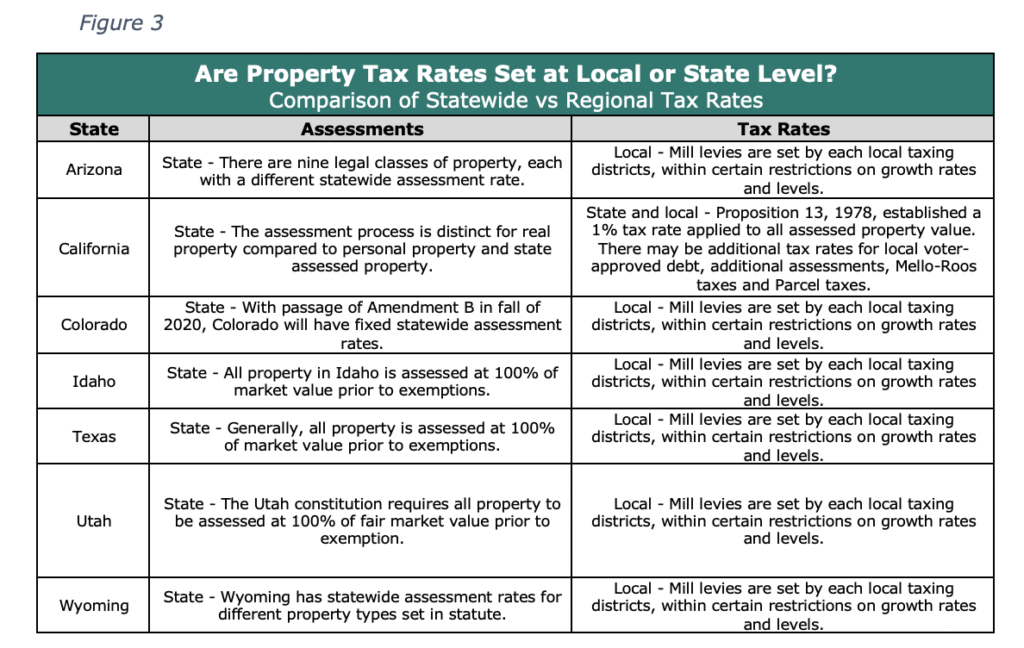

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Issue 301 Taxing Recreational Marijuana Sales In Colorado Springs Colorado Public Radio

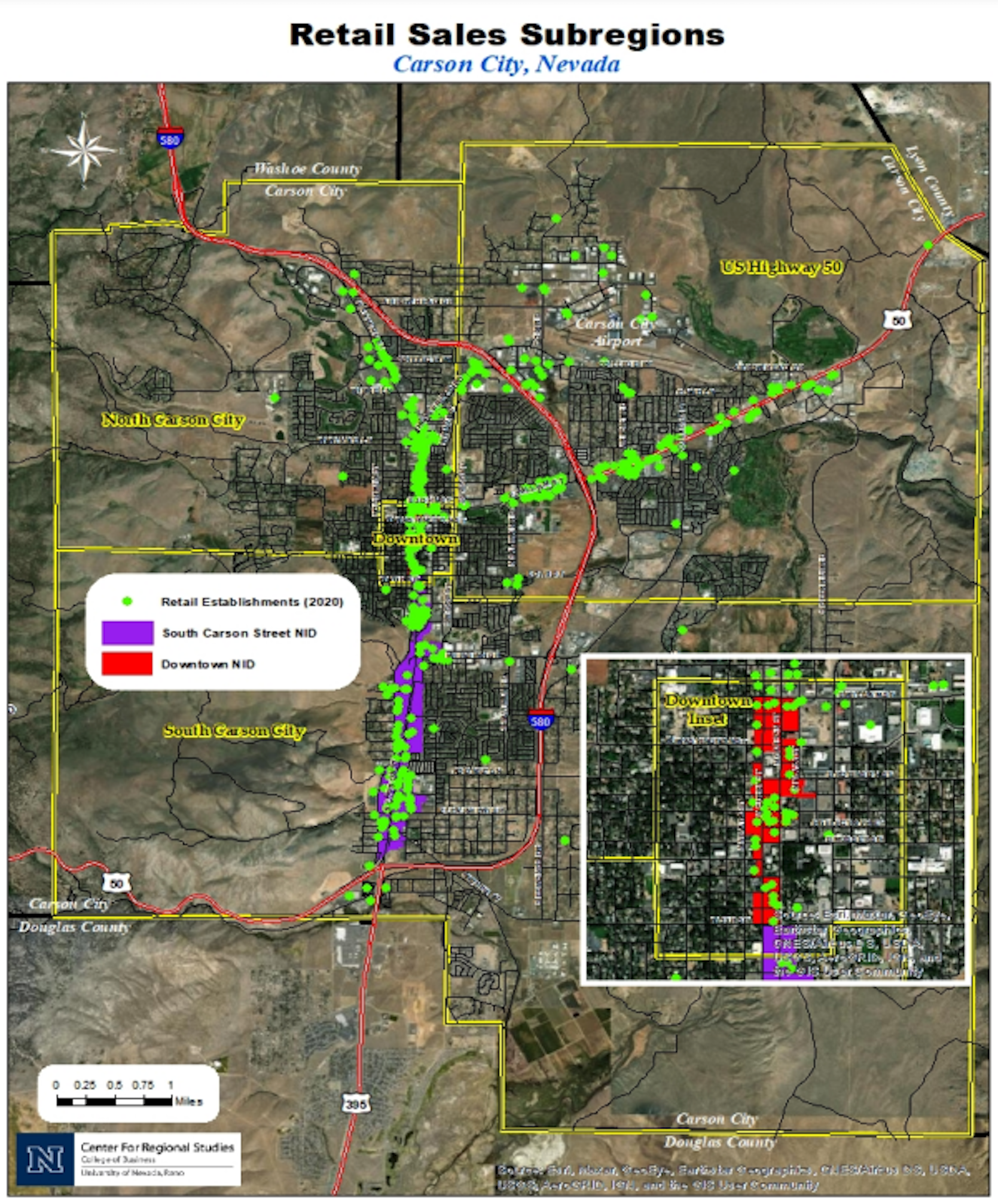

Supervisors Hear Reports On Carson City Sales Taxes Housing And Master Plan Serving Carson City For Over 150 Years

Sales Taxes In The United States Wikipedia

Used Cars Under 5 000 For Sale In Colorado Springs Co Vehicle Pricing Info Edmunds

Used Cars For Sale In Colorado Springs Mike Maroone Automotive Group

3650 Jeannine Dr Colorado Springs Co 80917 Loopnet

Why Do I Pay So Many Vehicle Registration Fees In Colorado 9news Com

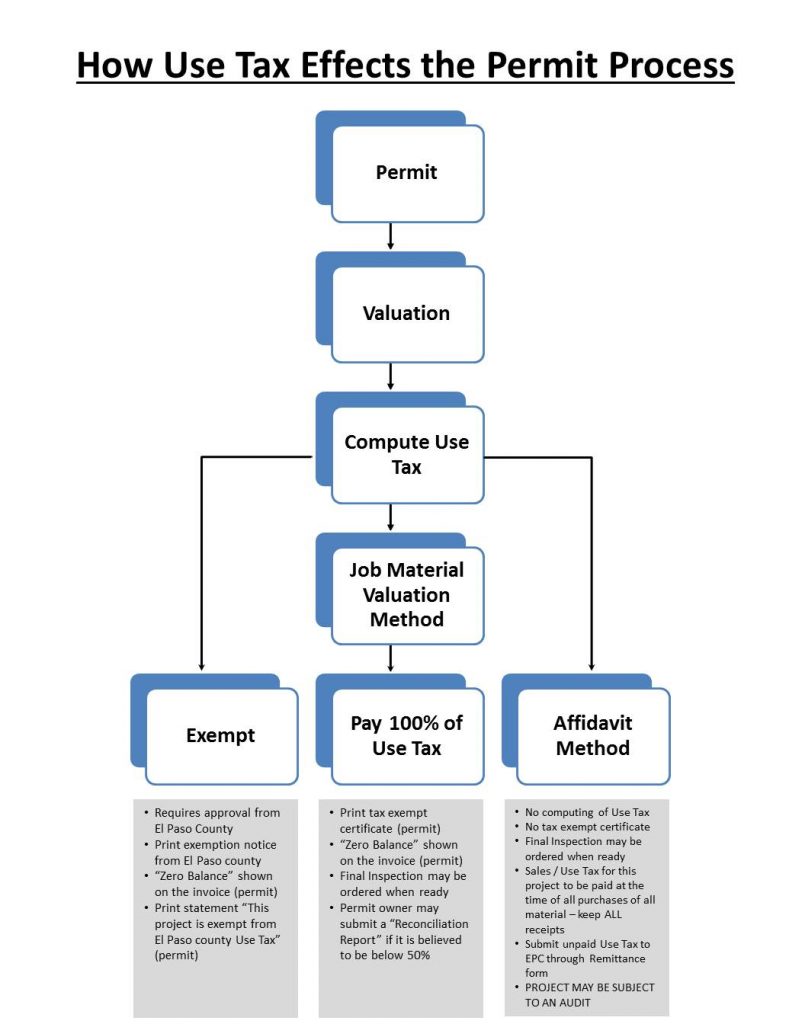

Sales And Use Tax El Paso County Administration

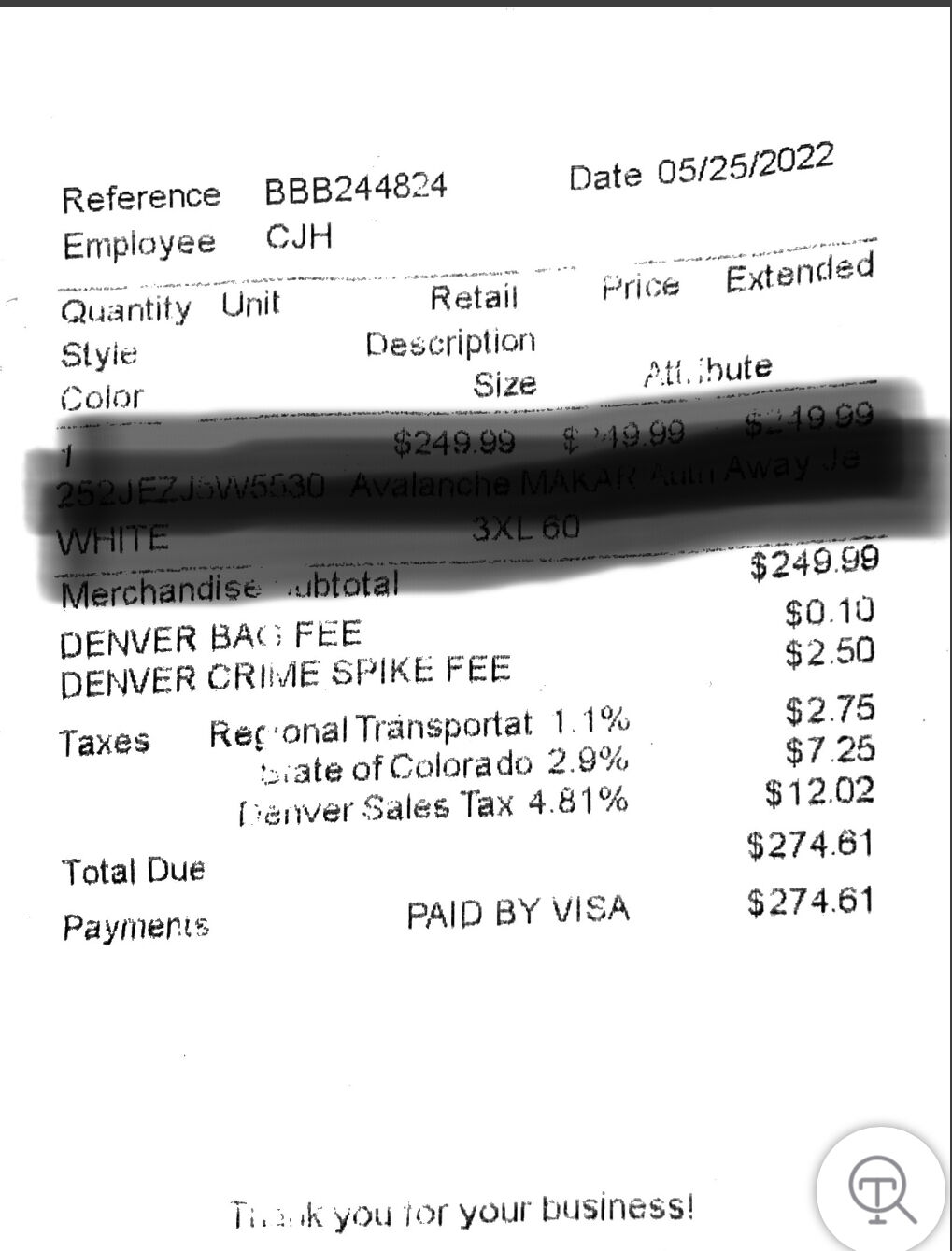

Downtown Denver Business Owner Levies Crime Spike Fee Business Denvergazette Com

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

New Jeep Gladiator For Sale In Colorado Springs Co

Colorado Springs Used Honda Inventory Honda Inventory

Can I Avoid Paying Sales Taxes On Used Cars Phil Long Dealerships

Inflation Nation Colorado Springs Residents Pummeled By Rising Prices Subscriber Content Gazette Com